Financial expert Ray Dalio urges investors to move assets out as he forecasts more than 1 in 3 chance of civil war in America

05/22/2024 / By Belle Carter

With the current political and economic situation in the United States, billionaire investor Ray Dalio has urged investors to move some of their money to foreign markets. According to him, this is because the chances of a second American Civil War stand better than one out of three and the U.S. government’s rising debt levels could hit Treasury bonds.

“We are now on the brink,” he said. But we “don’t yet know if we will cross over into much more turbulent times.”

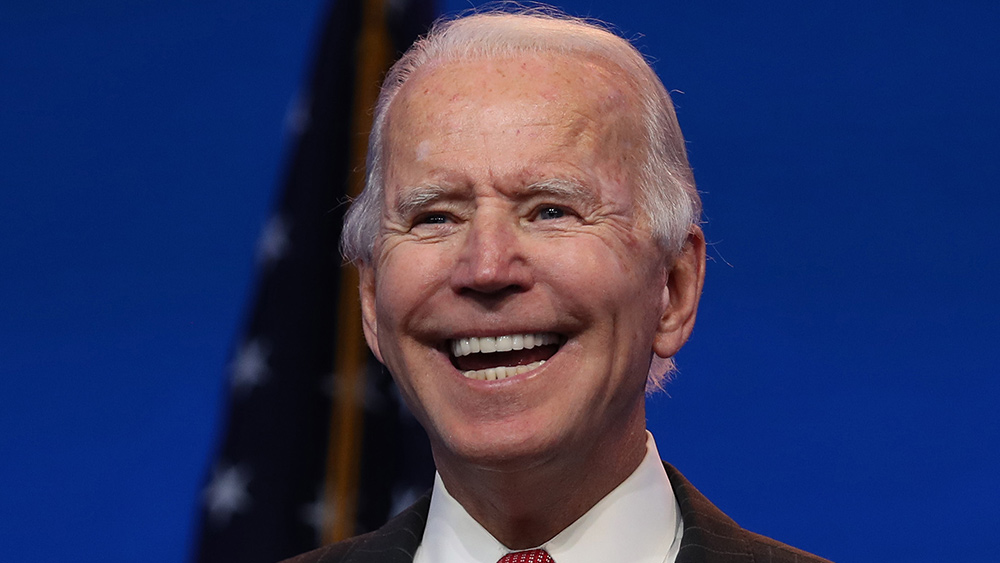

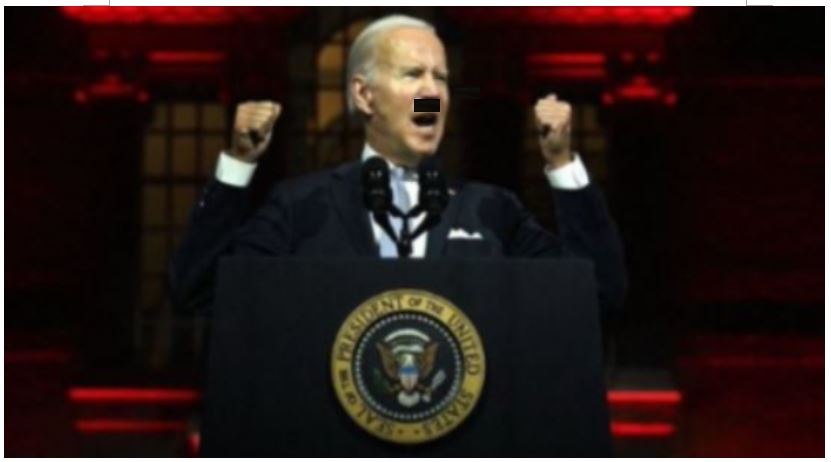

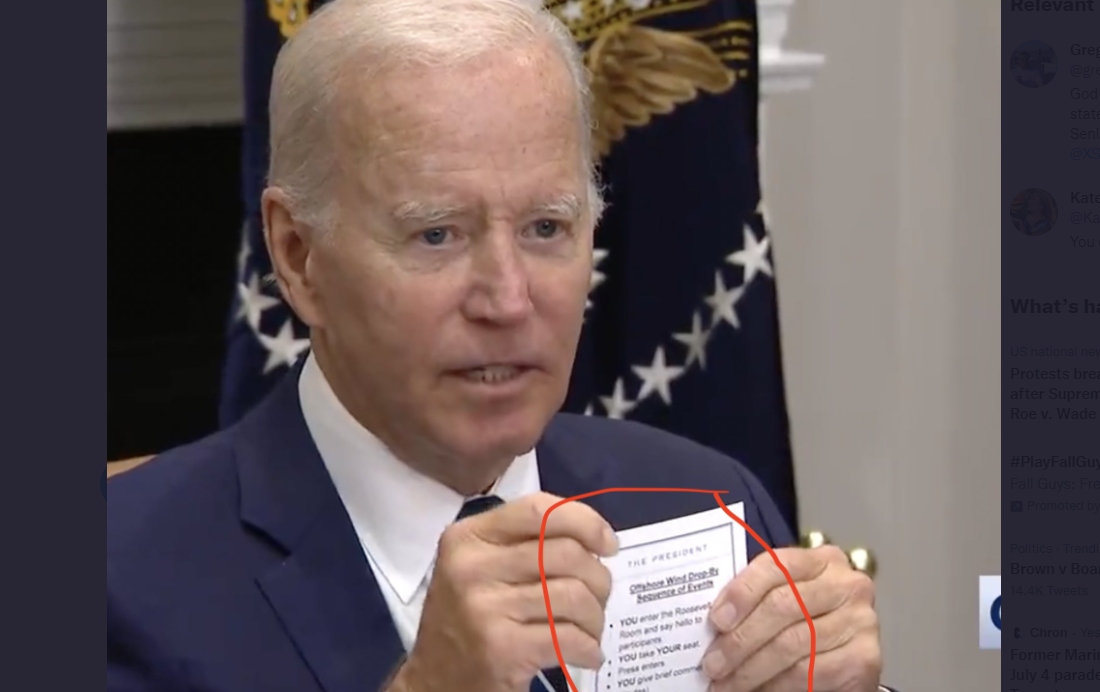

Dalio, who founded the world’s largest hedge fund, Bridgewater Associates, before relinquishing control in September 2022, believes this year’s presidential election between incumbent President Joe Biden and former president and Republican flag bearer Donald Trump is the most important one of his lifetime and will serve as a litmus test that determines whether politics, which include climate change and the impact of the more widespread use of artificial intelligence, will spiral out of control.

“This election could be a test of ‘Can democracy work well? Will there be an acceptance of the rules and an ability to work well under those rules?'” he said. Dalio declined to back a candidate.

Civil war seemed inconceivable only a few years ago. But the civil war Dalio imagines is not necessarily one in which people “grab guns and start shooting,” although such a scenario is possible, he said. In an interview with the Financial Times (FT), he estimated that the probability of strife erupting is somewhere between 35 and 40 percent. He said he sees the possible conflict as an acceleration of the political polarization in American politics that has taken place in recent decades. This civil war would be one in which “people move to different states that are more aligned with what they want and they don’t follow the decisions of federal authorities of the opposite political persuasion,” he explained.

In the interview, he also expressed his concern about the potential for the nation to become involved in another international conflict, which he warned could deter foreign investors from buying U.S. bonds. “I am?.?.?.?concerned about Treasury bonds because of the high debt levels, which high interest rates are adding to,” he said. “I’m also concerned about the softening demand to meet supply, particularly from international buyers worried about the U.S. debt picture and possible sanctions.” If the U.S. were to impose sanctions on more countries, like what it did to Russia for its Ukraine invasion, then that could reduce international demand for Treasuries, he added.

The warning comes in time to impact the discussions of the burgeoning U.S. debt pile. The Congressional Budget Office forecasts U.S. debt-to-GDP will rise above its Second World War high of 106 percent by the end of the decade.

Moreover, Dalio pointed out that although the best parts of the United States are still the best parts of the world for capitalism and innovation, the risks the country faces are on the rise and make geographic diversification necessary. “Countries that earn more than they spend and have great balance sheets, have internal order and are neutral in the geopolitical conflicts?.?.?.?look attractive,” Dalio added, mentioning India, Singapore, Indonesia, Malaysia, Vietnam and some Gulf states as potentially attractive destinations to invest. He added that gold was also a good diversifier.

Almost half of American voters see the possibility of Civil War 2 in the next 5 years

According to Rasmussen Reports, which surveyed 1,105 likely voters in America, the possibility that the nation could face another civil war soon is not too far-fetched for a lot of voters.

The latest national telephone and online survey finds that 41 percent of those sampled believe the United States is likely to experience a second civil war in the next five years. This includes 16 percent of those who consider such a scenario “very likely.” Forty-nine percent do not think another civil war is likely in the next five years, including 20 percent who chose it is “not at all likely.” The remaining 10 percent are not sure what to answer to the poll question. (Related: Elitist one-percenters behind brewing cultural civil war in America.)

Meanwhile, the new movie “Civil War” made its debut as No. 1 at the box office last month. The film is about a dystopian future America, where a team of military-embedded journalists race against time to reach Washington D.C. before rebel factions descend upon the White House. The film written and directed by Alex Garland includes Kirsten Dunst, Wagner Moura, Cailee Spaeny, Stephen McKinley Henderson, Sonoya Mizuno and Nick Offerman as cast.

The film has raised concerns and spawned discussions on the possibility of conflict. Thirty-seven percent of voters now believe another civil war is more likely to happen if Biden wins this year’s election, while 25 percent think another civil war is more likely if Trump wins. Thirty percent said who wins this year’s election will not make much difference in the likelihood of a civil war.

The poll had a margin of sampling error of +/- 3 percentage points with a 95 percent level of confidence.

Check out Collapse.news for stories related to the possible downturn of the United States as its political and economic affairs crumble.

Sources for this article include:

Submit a correction >>

Tagged Under:

assets, Biden, chaos, civil disobedience, civil unrest, civil war, collapse, debt bomb, debt collapse, economic downturn, economic riot, elections, finance riot, financial riot, government debt, investments, money supply, National Divorce, national security, ray dalio, treasuries, Trump, uprising

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 JOEBIDEN.NEWS

All content posted on this site is protected under Free Speech. JoeBiden.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. JoeBiden.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.