Consumer sentiment dropped further in May, survey reveals

06/01/2022 / By Belle Carter

A recent survey conducted by the University of Michigan revealed that consumer sentiment plunged to a final May reading of 58.4 from the initial reading of 59.1 earlier in the month.

“This recent drop was largely driven by continued negative views on current buying conditions for houses and durables, as well as consumers’ future outlook for the economy, primarily due to concerns over inflation, ” wrote Joanne Hsu, director of the consumer survey.

Expectations for the year-ahead price are at the lowest level in more than 10 years. Americans’ expectations for overall inflation over the next year fell to 5.3 percent in May from 5.4 percent in April.

A key measure of U.S. inflation released on May 27 showed prices for a typical basket of consumer goods rising 6.3 percent year-over-year in April, down from a 40-year high of 6.6 percent in March.

“A stable outlook for personal finances may currently support consumer spending. Still, persistently negative views of the economy may come to dominate personal factors in influencing consumer behavior in the future,” Hsu added.

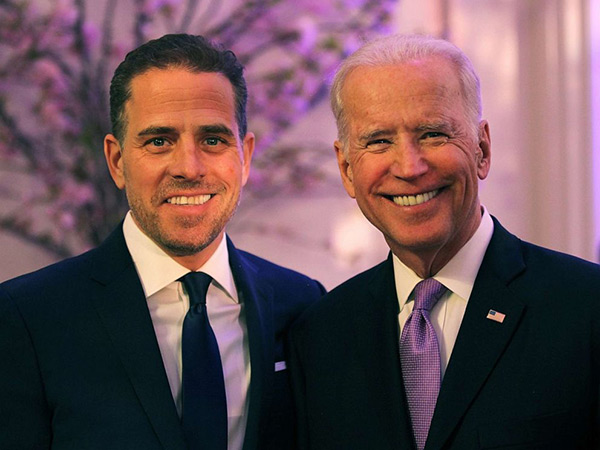

The economic indicator clearly shows that consumers are losing faith on how the current administration’s economic policies are implemented as inflation is at its highest level in 40 years. (Related: “Bidenflation” triggers stunning downfall of consumer sentiment to 10-year low.)

“Bidenflation” tax costs every household $5,000 a year

The responses in the survey may have been influenced by a report published earlier this year disclosing that inflation under the Biden administration is costing American families an average of $5,000 a year.

A report by the Washington Examiner noted that Senator Joe Manchin of West Virginia is correct to speak out over his concerns regarding inflation that is impacting U.S. households worse than any time in the past 40 years.

“The painful Biden inflation tax is costing the typical family $5,000 a year,” wrote Bruce Thompson on the news website.

Thompson said a new analysis of the Penn Wharton Budget Model found that inflation costs the average U.S. household $3,500 in higher prices. The analysis showed that “inflation requires the average U.S. household to spend around $3,500 more to achieve the same level of consumption of goods and services as in previous years.”

Subsequently, lower-income households are forced to spend even more, the study said.

However, the evident loss of confidence of the public to the government has been downplayed by mainstream media and the authorities as they portray the inflation hike as temporary.

Federal Reserve Chairman Jerome Powell and Treasury Secretary Janet Yellen initially viewed inflation as temporary and almost wholly driven by factors unique to the pandemic.

Some White House economists have asserted that the current stretch looks not like the stagflation era, but more like the immediate post-World War II climate, when price controls, supply problems and extraordinary demand fueled double-digit inflation gains that didn’t subside until the late 1940s.

Forecasters underestimate inflation

Last year, forecasters greatly underestimated U.S. inflation and the initial surge was dealt with optimism. They expected supply chain shocks caused by the pandemic to be temporary and saw little evidence inflation would persist or rise further.

Inflation was initially limited to product categories with clear supply shocks, but is now broad-based, and there are growing anecdotal reports of wages chasing higher prices and prices adjusting for higher costs.

By February 2022, forecasters had revised 2022 inflation expectations to 3.1 percent. The analysts believe that the rise in energy prices brought about by the sanctions on Russia will likely lead to further upward revisions.

“Accurately gauging the path of future inflation is critical for determining how quickly monetary policy needs to move to a neutral stance to avoid a scenario of persistent inflation, which would require even more tightening in the future and risk another recession,” Karen Dynan of the independent and non-profit Peterson Institute for International Economics (PIIE) wrote on their site.

Visit Collapse.news for more updates on the economic situation in America.

Watch the below video that talks about how Americans are feeling the Bidenflation.

This video is from the NewsClips channel on Brighteon.com.

More related stories:

EPIC FAIL: Biden’s first year in office marred by worst annual inflation in four decades.

Biden: Inflation is everybody’s fault but mine.

Latest polls show Biden failing on economy, inflation, immigration, crime.

Food shortages reached record high in April as inflation continues to skyrocket.

Sources include:

Submit a correction >>

Tagged Under:

Bidenflation, big government, bubble, collapse, consumer sentiment, debt bomb, debt collapse, economic crisis, inflation, Janet Yellen, Jerome Powell, Joe Biden, Joe Manchin, Penn Wharton Budget Model, recession, risk, University of Michigan

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 JOEBIDEN.NEWS

All content posted on this site is protected under Free Speech. JoeBiden.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. JoeBiden.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.